REAL WORLD

Evaluate real world outcomes

using our simulation tools

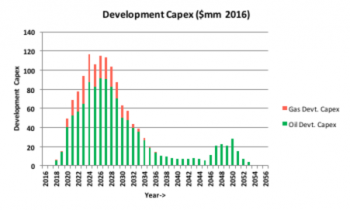

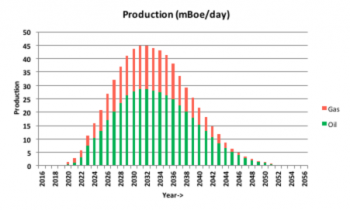

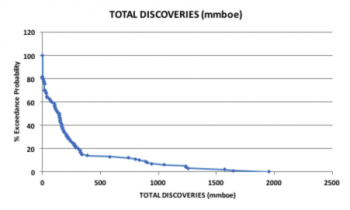

EPEX is able to evaluate real world portfolios across the value chain from exploration through appraisal, development through to production in a sophisticated statistical way such that executives can develop a feel for the likelihood of meeting targets and can ask “what-if” questions of their portfolio.

EPEX can simulate portfolios ranging from a single asset to a 100+ asset company with programmes ranging from a single well to multi-well programmes with multiple pre and post production assets.

The analysis can cope with independent and dependent risks and covers ranges of outcomes of all the primary variables (volume, cost, timing, price, timing etc).

People often fail to undertake the proper analysis and hence make bad decisions due to:

- Inadequate description of the range of uncertainty (usually too narrow)

- Misunderstanding of dependent and independent risks

- Poor characterisation of running room beyond the initial plans

- Poor understanding of option value and hence the timing of opportunity entry

- Poor aggregation of play, prospect, reservoir risk elements

- Overly simplistic aggregation of portfolio outcome range and exceedance likelihood

- Lack of incorporation or over simplistic economic limit assessment

- Inadequate incorporation of new information into decision making

- Limited testing of scenarios

- Lack of appreciation of what aspects are driving value

- Management requirement for deterministic cases skewing decisions

Our XPS tool will help clarify how your portfolio performs and the range of outcomes you can expect to help you make those difficult decisions.

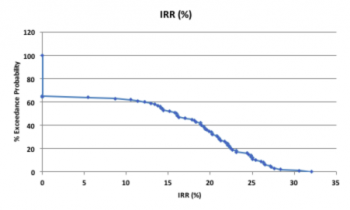

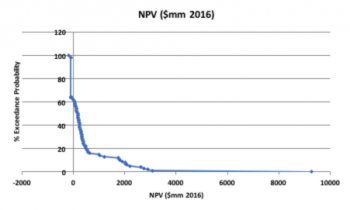

Answers can be presented graphically as well as through a report.

It can answer a host of questions such as:

- What is my portfolio really worth on a risked basis?

- If this play works what might things look like?

- Is my portfolio really robust if prices fall?

- What portfolio management options might I have?

- If I farmed out certain aspects would I be able to afford certain new ventures?

- What if I delayed certain projects what might my cash requirements be?